Theory vs. Practice

Diagnosis is not the end, but the beginning of practice.

The Hidden (Deadly) Costs of De-Correlating Price from Value

All that glisters is not gold.

Billionaire venture capitalist Marc Andreessen has recently stated:

"You're probably not going to get the bicycle manufacturing plant back that's going to build bicycles the way they existed 40 years ago. [...] What you actually want is you want to be making electric bikes, which are much more sophisticated physical artifacts that involve batteries and computers and chips."

I agree on the strategy but I disagree on the execution – because ever-growing complexity (an excremental process lacking a clear and sustainable vision for progress) is bad, not good.

Don't attempt to copy China – disrupt it:

I want a cheap, subscription-based, light, reliable, infinite-range battery-less bicycle – not a fragile, hackable, expensive, clunky smartphone on wheels obsolete within 2 years and requiring periodic battery replacement. If we deliver the former, we will get 100% of the global market – at the price we ask! If we make the second kind, we will compete on price with China... and lose, again.

30 years ago we had software or devices lasting decades. Today, APACHE has 18+ CVEs per month and NGINX 4+. Hardware routinely fails after a one-year warranty. Planned-obsolescence enriches a very few via eventually-failing "circular deals", but it destroys productivity and therefore our economy: people prefer things that actually work, seamlessly, and on the long-term.

Sustainable profit is not achieved by extracting more and more money from the ever-depleted pockets of consumers and governments – it is granted by offering immensely better alternatives to the general sorry state of things.

What is needed (to please customers – the ones paying for the products), is ground-breaking technologies cutting manufacturing and operating costs rather than incremental complexity generating ever-rising costs.

Economic Value is defined in "Principles of Economics" by Carl Menger (1871), as: "the importance of the goods at their disposal for the maintenance of their lives and well-being". Value is how much a product satisfies... end-user needs.

Price is what you pay. Value is what you get.

Economists have defined "Equilibrium" as "perfect markets", that is: perfect information, perfect competition, real-time price adjustments, zero transaction additional costs, profit maximization of rational, uninfluenced agents.

But "Equilibrium" is yet another academic abstraction (a "fictional story") not reflecting reality: heavily-subsidied battery-powered cars are a nonsense for the economy (debt, subsidies), ecology (unrecyclable batteries, mining of rare earths), technology and sustainability (the manufacturing, storage, transportation and distribution of batteries, bioenergy, solar panels and wind turbines rely on... fossil fuels).

Batteries are unsafe, expensive, and need replacements. Lossy (when charging/decharging), fast-degrading batteries are not approaching the constant power-to-weight ratio of the internal combustion and turbojet engines getting their oxidant free-of-weight from the atmosphere. Batteries won't ever power heavy planes and helicopters.

Planned inefficiency was imposed by Finance-owned government regulations to defeat the natural market leaders (making the most desirable products), a self-defeating, myopic defensive tactic (to promote a very few Finance-owned carbon-tax credits BigCo beneficiaries).

Chinese cars now outperform Tesla cars because electric engines and drive trains are cheaper and simpler than for high-end petrol engines.

There was no distinctive Value making this switch sustainable – so we have lost, again.

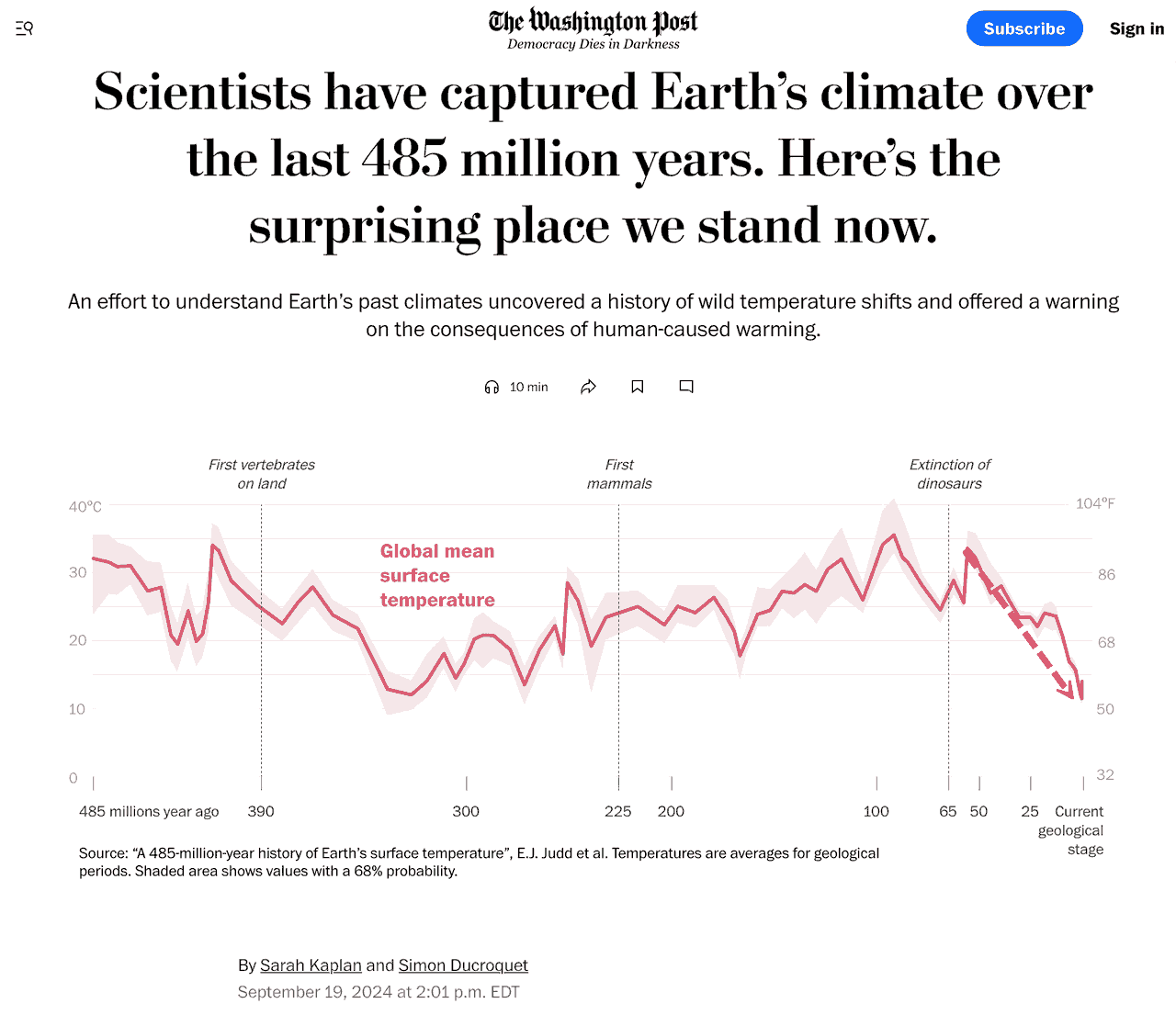

Worse, we have lost due to a "fictional story", a well-funded scientific fraud called "global warming": on 485 million years, the temperatures today are actually some of the coldest ever recorded!

It took 25 years for the "peer-reviewed" scientific community to retract a 2000 study fraudulently claiming that "roundup and glyphosate are safe for humans"... despite plenty of evidence of the contrary, since day one.

In both of the above cases, the same billionaire, well-known for having funded decades of criminal activities while always escaping judicial sanctions, was (again) involved to actively "sponsor" Science to create the fraud, and the public regulators to use this scientific fraud as a government regulatory tool (a very recurring pattern).

The U.S. National Academy of Sciences (NAS) has published "The entities enabling scientific fraud at scale are large, resilient, and growing rapidly" with the publication of fraudulent papers growing at an even faster rate than legitimate publications. It even got a name: "paper mills" relying on AI fake research, forged pictures, and the coordination between editors and authors for the publication of outrageously fraudulent peer-reviewed science published by the most reputed journals.

Due to infinite funding, the largest economic players enjoy undue gains at the expenses of all others: by increasing the price while diminishing the utility-Value of the goods and services: durability (planned obsolescence), quality / quantity, manipulated information (media, fake-science) to maximize profit by making buyers unable to evaluate offers.

AI-generated contents, Media cover-stories, fraudulent science, and obscure terminology (that is, disinformation) is the foundation of this blocked progress: greed, maximizing gains by fraud rather than increased Value, justifies an ever-growing degradation of moral standards, skills, quality, durability, and efficiency.

There is just a little problem with this short-term tactic: it will not end well. Fraud is profitable up to the point that it delivers ruin, again.

The only sustainable way to preserve the economic "Equilibrium" is through legitimacy: gaining market share because we deliver immensely better Value for the asked Price.

The USA have been the leading force behind many technological innovations disrupting world markets and letting the Western economy grow – without a fight. That's where the Value is, for our know-how, our people, and our economy.

That's also where the investments should go – unless the taxpayers want to keep losing while enriching the "Too Big to Fail" crooks.

Linking Today's Manufactured Chaos To The World's History

Charles A. S. Hall has created a measure called the "energy return on investment" (EROI). A decline in energy returns would eventually cause the closure of mines and industries, adversely affect agriculture, leading to a brutal drop in living standards.

As WET, deployed a century ago, allows to tap constant 24/365 ubiquitous geothermal resources, the purposely misleading scenario of declining natural resources (promoted to justify a drastic population reduction) is a "fictional story", a plan that can become reality only through the manipulation of Science by Finance to favor the Finance-owned least efficient players (a recognizable pattern):

When Finance-owned governments tax fossil fuels usage and mandate electrification (while blocking a 2014 WET prototype presented at the Munich Security Conference 2019 – to keep prescribing the much more expensive LNG, solar panels, wind turbines and batteries), progress is artificially stopped (AI, chips, drones, robots, med tech, clean tech, EVs, telecom, manufacturing, power plants and grids) for the sake of "arbitration", that is, to pick the winners – a foundational bankers tactic (erecting impossibly high market entry barriers, to exclude all other economic players):

"The members of society are unequal only to the extent that their capitals are unequal, as capital is the decisive power, the capitalists, the bourgeoisie, have become the first class in society.

Having destroyed the social power of the nobility and the guildmasters, the bourgeois also destroyed their political power. Having raised itself to the actual position of first class in society, it proclaims itself to be also the dominant political class."

– Karl Marx (1818-1883) and Frederick Engels (1820-1895), The "Communist Manifesto" (1848)

Banks decide how much debt money is created, given to who, to do what. Nothing can happen without them. If banks stop issuing loans, there's not enough circulating money to pay back debt – and the targeted debtor (a company, a country, or the global economy) defaults. Therefore, as the 1848 "Communist Manifesto" states, "capital is the decisive power". Exit competence and merit.

Why fund ever-growing inefficiency and waste while discouraging efficiency? In the United States, the amount of private debt required to produce $1 of GDP growth was: $2.37 in the 1980s, $2.99 in the 1990s, $5.67 in the 2000s – and an unpublishable level today – hence the WEF "Great Reset" (the bankers will own the whole Planet, but "you will own nothing and be happy").

And the founders of Communism knew so well how Capitalism went to power because... the Communists were funded by the Capitalists: after Stalin's death in 1953,

The [1947-1991] Cold War degenerated into a farce, as the West, and in particular the United States, invested heavily in the Soviet Union.

In 1991 the Soviet Union imploded and a swarm of advisers arrived from the USA, who introduced the wonders of unregulated free market capitalism which included income tax and usury. [...] For almost 200 years the Tsars and Soviets resisted, but finally Russia fell entirely into the hands of the Rothschilds.

That puts some famous declarations in perspective:

The best way to control the opposition is to lead it ourselves.

"Wall Street and the Bolshevik Revolution" (1974) by Antony Cyril Sutton (British-American economist), or a a 1920 article by Winston Churchill, or the 1932 speech of Louis T. McFadden, former chairman of the U.S. House Banking and Currency Committee certainly help to explain this apparent contradiction:

The 1848 "Communist Manifesto" had the same program as the 2020 "World Economic Forum": confiscation of private property, a Central Bank exclusive monopoly (planned to be soon imposed worldwide with CBDCs – Central Bank Digital Currencies), and monopolies for energy, communication, transport, commerce and the industry.

Are Russia and China still the Capitalism "fake opposition"?

Russia and China are at the forefront of CBDCs (with digital ID and social credit for China) – while Europe did not deploy them yet.

China has been paid by the USA to enhance the lethality of the Corona virus because "gain of function" research leading to bioweapons was forbidden in the US (it's now official: Anthony Fauci, director of the US National Institute of Allergy and Infectious Diseases (1984-2022), and chief medical advisor to the US president (2021-2022) did everything he could to hide this clandestine joint project).

Remember that, under the COVID crisis, a digital "vaccination passport" was deployed to identify and sanction (that's the digital ID and social credit bundled together) the reluctant citizens that declined to take the jab (advising against it was an even more severely punished offense). Many have lost their jobs, were debanked (their bank accounts were frozen), and some are still in jail today.

But a secret collusion (leading later to millions of EU and US deaths) is not the only problem – there is also substantial cognitive dissonance:

In October 2024, Russia's Central Bank director, Elvira Nabiullina, has raised interest rates (with Vladimir Putin's approval) to stop the spiral of inflation that debt money invariably generates, leading to an official 2026 forecast of a declining 0.5% growth. Russia President Putin certainly knowns about inflation-free debt-free interest-free State money – successfully deployed in the past by many countries... including Russia in 1860.

So, instead of reverting to its previous, so successful, Tsarist Russian State bank, Russia (officially fighting against an EU/USA Western coalition) relies on a Central Bank (a Western creature based on usury and therefore generating debt and inflation since new debt is required to pay back old debt with taxation), and Russia's 2025 wish is to join a... Western AI-based "Emerging World Order":

"Politically, Russia would be part of an exclusive club for setting all other international groups' agendas; economically, it could more easily leverage its resource wealth to receive high technology from the other members, including AI in exchange for letting them set up data centers that would be powered and cooled by its nearly limitless hydroelectric potential; and strategically, Russia would jointly shape the emerging world order."

For having been personally robbed, denigrated, sabotaged and excluded by the same unfair tactics that have targeted Russia, I find this an understandable and even a legitimate goal: after all, Russia has long demonstrated its capacity to act, and its untapped natural resources potential is unmatched. If, unstead of being excluded, it was involved in positive changes for mankind, then the world would most probably become a better place, faster, and with less injustices and frictions.

But, hey, to convince me (and the rest of the world), the willing candidates and the (unknown) promoters of this "emerging world order" should quickly and seriously demonstrate that it comes in frontal contradiction with the previous plan funded by Wall Street (see their previous "New World Order" later in this article).

In the past, the ruling groups of all countries, although they might recognize their common interest and therefore limit the destructiveness of war, did fight against one another, and the victor always plundered the vanquished. In our own day they are not fighting against one another at all. The war is waged by each ruling group against its own subjects, and the object of the war is not to make or prevent conquests of territory, but to keep the structure of society intact.

Even Winston Churchill has publicly stated that the 1917 Communist Revolution has been planned and funded by the "international Jews" (that he depicted as nefarious and distinct from the "good, national Jews" that he was admiring):

The International Jews. The adherents of this sinister confederacy are mostly men reared up among the unhappy populations of countries where Jews are persecuted on account of their race. Most, if not all, of them have forsaken the faith of their forefathers, and divorced from their minds all spiritual hopes of the next world.

This movement among the Jews is not new. From the days of Spartacus-Weishaupt to those of Karl Marx, and down to Trotsky [alias Lev Davidovitsj Bronstein] (Russia), Bela Kun (Hungary), Rosa Luxembourg (Germany), and Emma Goldman (United States), this world-wide conspiracy for the overthrow of civilisation and for the reconstitution of society on the basis of arrested development, of envious malevolence, and impossible equality, has been steadily growing. It played, as a modern writer, Mrs. Webster, has so ably shown, a definitely recognisable part in the tragedy of the French Revolution.

It has been the mainspring of every subversive movement during the Nineteenth Century; and now at last this band of extraordinary personalities from the underworld of the great cities of Europe and America have gripped the Russian people by the hair of their heads and have become practically the undisputed masters of that enormous empire.

The same year, in 1920, this "world-wide conspiracy for the overthrow of civilisation" denounced by Churchill was unequivocally celebrated by its perpetrators as the first step of a more ambitious, global plan:

The Bolshevik Revolution in Russia was the work of Jewish planning and Jewish dissatisfaction. Our Plan is to have a New World Order. What worked so wonderfully in Russia is going to become Reality for the whole world.

Nobel Prize Alexander Solzhenitsyn (1918-2008) has explained how "wonderful" this "New World Order" has been for the Tsarist Russia:

On 17 November 1917, the Rothschilds, fearful that replication of this [Tsarist Russia] extraordinary example of freedom and prosperity would destroy their malevolent banking empire, instigated and financed a Judeo-Bolshevik revolution in Russia, which wrecked and ruined a wonderful country and resulted in the deaths by murder and starvation, according to Alexander Solzhenitsyn, of 66 million innocent people.

Wow. School textbooks, newspapers and politicians focus on an 11 times smaller genocide, but don't mention this one (which did not trigger many decades of monetary reparations to the affected families). This reveals how much we are deprived from our own History.

Now, to see if today's chaos is due to the "New World Order" of Churchill's "sinister confederacy", we have to check what has changed since 1920, and how it was done – so we have a chance to undo it... before (or after) we all have been ruined, again.

How It Was Done "With The Stroke Of A Pen" – Is Also How Fast It Can Be Undone

The market was supposedly a (buyer-driven) mechanism for price discovery: people would buy performing companies to get a dividend.

But as publicly traded stock depends on company valuations influenced by (notoriously inaccurate) Notation Agencies owned by... investment banks, it was rather a tool for wealth extraction by its largest players (the famous "whales" in love with "pump & dump") who were able to quickly buy/sell in large amounts to completely change market positions, making hefty profits).

When fraud is not stopped, it grows further, and the market has become a liquidity-driven hallucination, promoting nonsensical narratives that substitute for actual financial performance and industrial value (ie: Cryptos and fake AI).

Buyers face "fictional stories" with no earnings and lifetime negative cash flow that behave like they are invincible gods – merely because they are infinitely funded. These market distortions eventually resolve themselves, in a general bloodbath (with the guilty making gigantic profits):

In 1928, based on past productivity gains and consequent per capita growth in national income, John Maynard Keynes predicted that a century later, we would be so prosperous that we would no longer have to work.

Productivity growth and per capita income growth have ended at the upper end of Keynes' predicted range. So what is the cause of prosperity was achieved.

Keynes could not imagine that the benefits of this vast prosperity would be so unequally distributed that the elites would capture it almost entirely for themselves and the majority of the population would still need to work.

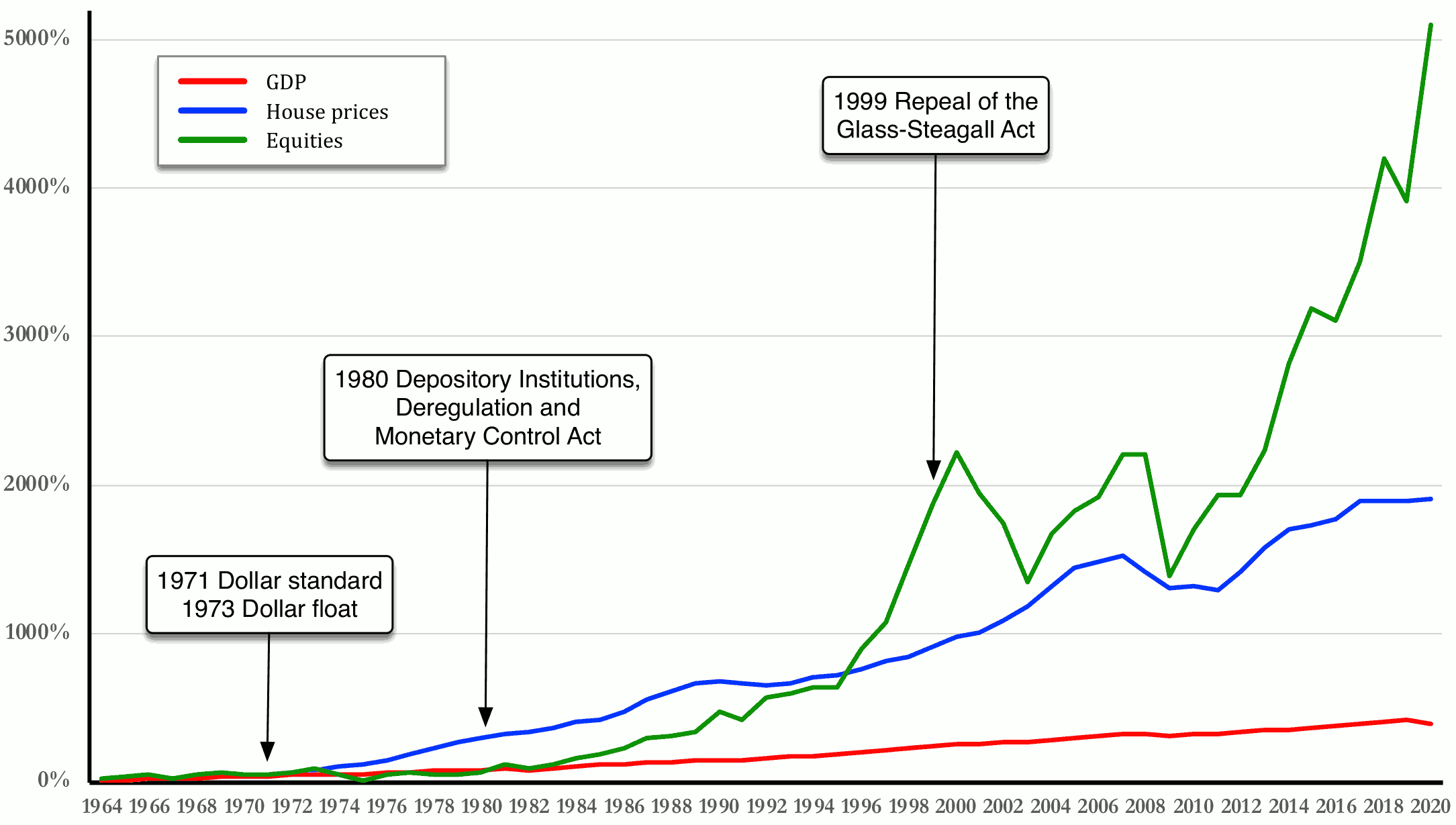

With their infinite magic money creation, banks have de-correlated Price from Value, on an exponentially-growing massive scale.

I am afraid the ordinary citizen will not like to be told that the banks can and do create and destroy money. The amount of money in existence varies only with the action of the banks in increasing or decreasing deposits and bank purchases. Every loan, overdraft or bank purchase creates a deposit, and every repayment of a loan, overdraft or bank sale destroys a deposit.

Banks decide how much debt money is created, given to who, to do what. Nothing can happen without them. If banks stop issuing loans, there's not enough circulating money to pay back debt – and the targeted debtor (a company, a country, or the global economy) defaults. Therefore, as the 1848 "Communist Manifesto" states, "capital is the decisive power". Exit competence and merit.

While our GDP (Gross Domestic Product) slowly grows, real-estate prices rose 5 times faster due to an artificially-created bubble caused by Finance constantly buying to maintain high prices (exchanging virtual fiat money –'fiat' means 'trust' in Latin– for tangible land and real-estate assets):

Yet, the real-estate bubble has been dwarfed by the exponentially-growing publicly-traded stock bubble (where our chronically indebted pension funds are "investing for our better good" and where private Central Banks so aptly invest the public money they honestly manage on our behalf – "independently" so we have no way to stop them).

Founded in 1913, the FED is a private bank with 12 regional Federal Reserve Banks owned and managed by the To Big To Fail, 2008-bailed out private banks (Morgan Stanley, JP Morgan, Goldman Sachs...) that get a 6% dividend from the FED – every year.

With the FED, the bankers have grown public/private debt with extravagant ever-increasing deceptive expenses like constant real wars, almost a thousand of U.S. foreign military bases, the 1947-1991 "Cold War" (funded by the West to let the U.S. and USSR justify never-seen before levels of military expenses... in times of peace), and the eye-wateringly expensive fake space conquest.

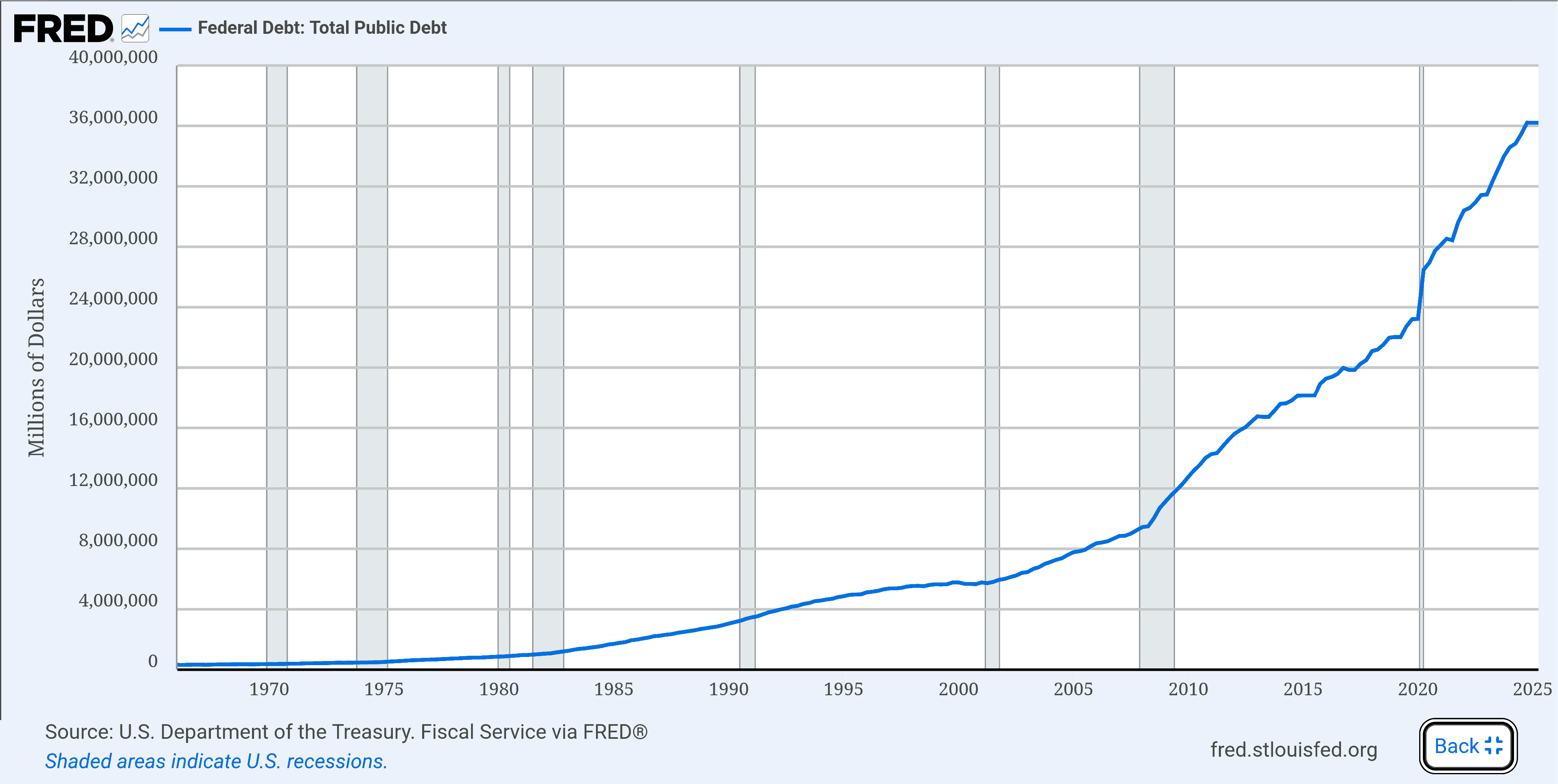

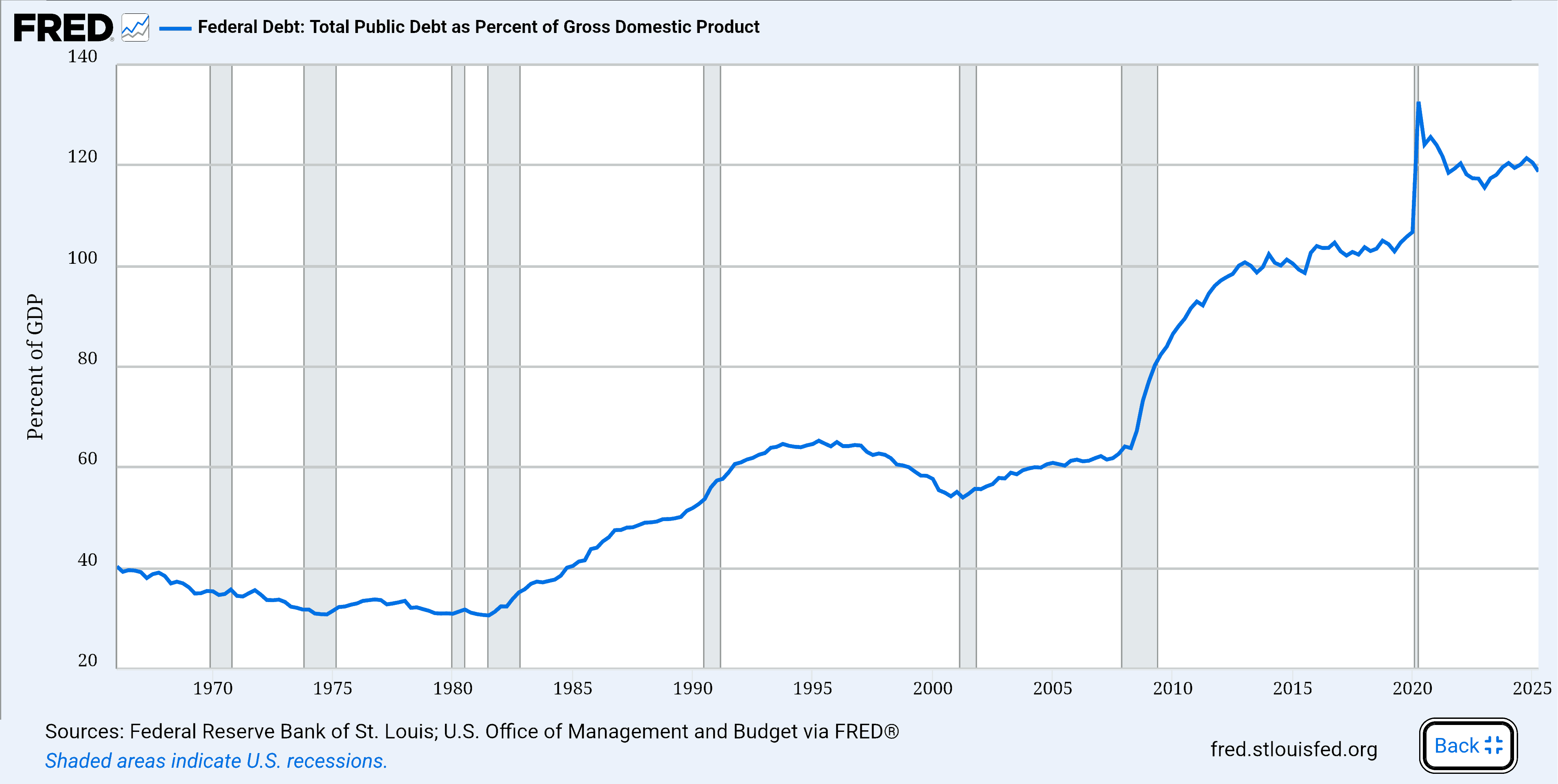

Since 1913, the FED lends these magically-created dollars to the US Treasury to pay for the ever-expanding US government deficits... while the taxpayers pay interest to the FED for those created, lent dollars (National Debt Hits $38.09 Trillion, Increased $2.18 Trillion Year over Year, $5.97 Billion Per Day on Nov 2025, but the FED charts below stop earlier, on April 2025):

The 2008 bailouts and 2020 COVID crisis are more visible on the second chart because while most of the the newly issued public-debt came to the bankers' pockets, the rest of the economy has been flatened – by an economic crisis, and the COVID lockdowns (an injustifiable measure: it is long known by Science that locking-down sane people can only have detrimental effects on their health).

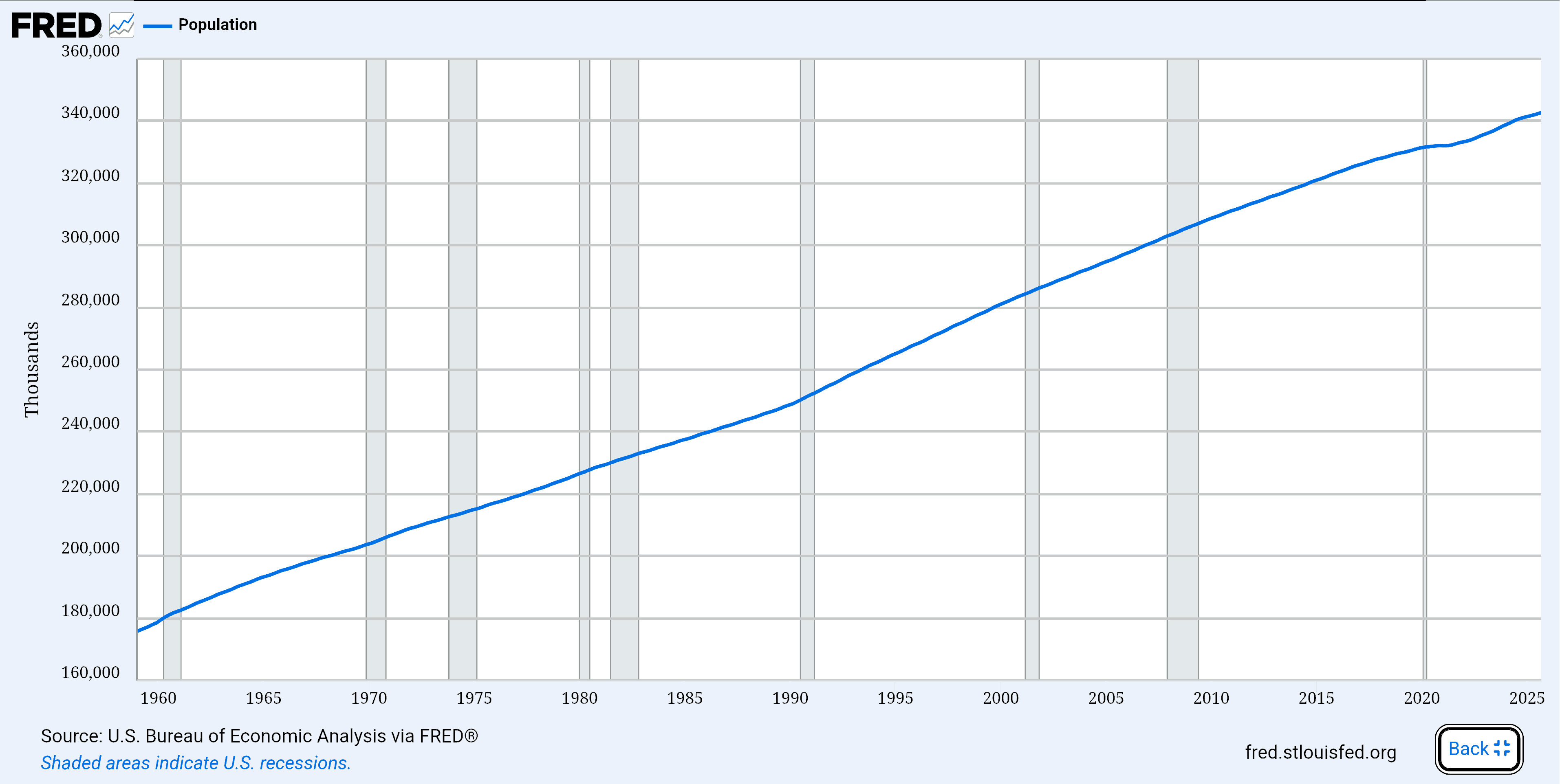

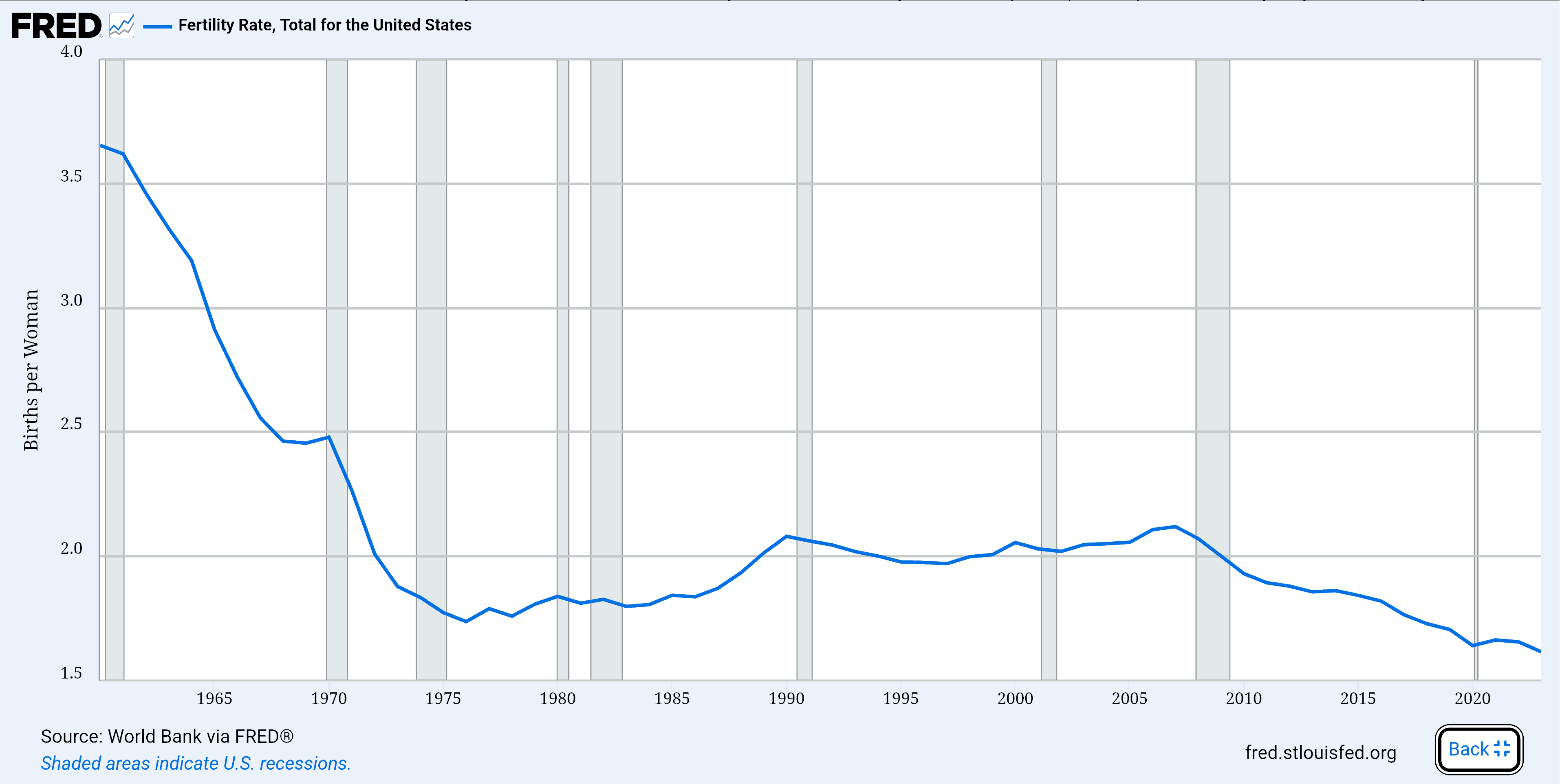

But while the total population increases (with the immigration of "positively discriminated" minorities), American babies decrease (a decline correlated to U.S. recessions). Like in Europe, the ever negatively-discriminated, so-called "white-supremacist" is eradicated:

This decline is not accidental: this is the result of decades of public policies enforced by governments that, systematically, prefer to give jobs, tax-breaks and subsidies to uneducated foreigners – to destroy merit (crooks see legitimacy as a deadly threat):

And the man who loans money to governments, so called, for the purpose of enabling the latter to rob, enslave and murder their people, are among the greatest villains that the world has ever seen.

Since 1913, The FED has the power to create unlimited dollars which it then lends out (to the U.S. Treasury) for interest payments, that is, profit to itself.

In 1913, the income tax (previously only raised in times of war) became permanent (to pay back the interests of the since then ever-growing public debt): Congress added the 16th Amendment to the Constitution and the "Revenue Act" under which, individuals with income exceeding $3,000 were taxed at 1% and up to 7% for incomes exceeding $500,000 (rates that are much higher today).

And the FED shareholders, a few private banks, effortlessly profit while debasing the U.S. greenback:

During the 90 years (1820-1910) before the FED the U.S. dollar had retained its purchasing power. But in a mere 6 years (1914-1920), the FED (supposedly created to eradicate financial crises) created inflation to reduce the U.S. dollar value by 56.1%.

And since 1971, the US dollar has lost 99% of its purchasing power when measured against gold, the value unit that, in 1787, the US Constitution promised its dollar to protect its citizens (against money creation for unproductive expenses generating inflation).

This is the largest wealth and power transfer ever made in History: U.S. President Thomas Woodrow Wilson (1856-1924), a "Democrat" that led the USA into World War I, gave the FED, a private bank, the U.S. Constitutionally-mandated power (Article 1, Sections 8 and 10) to make and control the American money, measured in gold and silver.

Certainly, "the greatest crime of Congress is its currency system", but not all Congressmen were approving:

This act establishes the most gigantic trust on earth, such as the Sherman Anti-Trust Act would dissolve if Congress did not by this act expressly create what by that act it prohibited. When the president signs this act the invisible government by the money power, proven to exist by the Money Trust investigation, will be legalized. [...] The schemiest legislative crime of all ages is perpetuated by this new banking and currency bill.

Like in the U.S. and previously England, that is, by murder and corruption, the same public-private racket has been deployed worldwide:

Most of the US presidents, who have been assassinated, were involved in monetary reform. They are presidents Abraham Lincoln, James Garfield, William McKinley, Warren G. Harding and John F. Kennedy.

And, after public power has been captured by private interests, necessarily come the times of infinite wars:

This business of lending blood money is one of the most thoroughly sordid, cold blooded, and criminal that was ever carried on, to any considerable extent, amongst human beings. It is like lending money to slave traders, or to common robbers and pirates, to be repaid out of their plunder.

Sure of their impunity, the winners now proudly explain how they abuse others (the speaker makes a clear distinction between "humans" who invent "fictional stories", and "the believers" which "survival", as "animals", depends on the "fictional entities" invented by "humans"):

"We can cooperate with numerous strangers because we can invent fictional stories, spread them around, and convince millions of strangers to believe in them. [...] Money is probably the most successful fiction ever invented by humans. Not all people believe in God, or in human rights, or in the United States of America. But everybody believes in money. [...]

And as time passes, these fictional entities have become ever more powerful, so that today they are the most powerful forces in the world. The very survival of trees, rivers and animals now depends on the wishes and decisions of fictional entities such as the United States and the World Bank – entities that exist only in our own imagination."

– Yuval Noah Harari, lecturer in history at the Hebrew University of Jerusalem, "Why Humans Run The World" (June 16, 2015)

WEF Adviser Yuval Noah Hariri is also famous for: "The Planet No Longer Needs the 'Vast Majority' of the Population".

Today's fake "IA" (planned to cost $5T) is just yet another "fictional story" told by the proud storytellers to both increase their wealth and power at the expense of everyone else (an "AI bailout" executive order has already been signed to save the GAFAM from bankruptcy).

Economists call this deceptive practice "pump & dump". It is illicit because aimed at fraudulently breaking the academic "Equilibrium":

In 1636, the entirety of Dutch society went crazy over exotic tulips. As prices rose, people got swept up in a speculative fever, spending a year's salary on rare bulbs in hopes of reselling them for a profit. Mackay dubbed the phenomenon "The Tulipomania":

A golden bait hung temptingly out before the people, and one after the other, they rushed to the tulip-marts, like flies around a honey-pot. Nobles, citizens, farmers, mechanics, sea-men, footmen, maid-servants, even chimney-sweeps and old clothes-women, dabbled in tulips.

That's the purpose of the stock-exchange! But what is the purpose of fake AI?

On one hand, academic researchers explain that this fake AI (made by the proud storytellers) invents "fictional stories" and is therefore unable to do the most basic tasks reliably, and, on another hand, the Finance-owned scientists, newspapers and entrepreneurs tell us that AI will replace most of our jobs (whether or not AI is fake has no influence on this sacred goal):

The more new labor-saving machines are invented, the greater is the pressure exercised by big industry on wages, which, as we have seen, sink to their minimum and therewith render the condition of the proletariat increasingly unbearable. The growing dissatisfaction of the proletariat thus joins with its rising power to prepare a proletarian social revolution.

The goal is to justify (in the eyes of the public) the destruction by Finance of our economy – to then impose the WEF "Great Reset" leading to "stakeholders capitalism" (public/private monopolies) via a (fake) AI treating everybody (all but the "elite") as slaves. The difference with today (where the most competent players are excluded from the economy via illegal State-endorsed anti-competitive practices) is that nobody (nobody but the "elites") will have the right to participate to the economy.

Endgame: the structure of society will no longer be allowed to change. The rule of law will state that winners will stay in charge forever, and the losers will be slaves forever. The foundational goals of both Capitalism and Communism will be reached (at the cost of an ever-increasing decay of morality, skills and creativity).

Watch the very good "Artificial Justice" film to undertand how sneakily private companies will replace today's government agencies (Justice, Education, Police, etc.) by a fake AI. This is a lie because what is abusively called "AI" today is CONCEPTUALLY unable to do anything in a sensical manner (AI is just a scapegoat). Our "elites" just want to pretend the AI is in charge – while in fact they are behind every single decision... to stay in power, whatever it takes.

Since there is a far better way than a Revolution (as we will see below), beware about those calling for it: to impose Communism, the Wall Street-funded (read Sutton) Bolshevik Revolution (1917-1927) lead by Lenin has caused 66m deaths in Russia (read Solzhenitsyn), its sequel the Cultural Revolution led by Mao Zedong (1966-1976) in China has caused 148m deaths (read Brzezinski), and WWII (1939-1945) 85m deaths (where Capitalism and Communism, that is Wall Street, joined forces to destroy... Germany; again, yes).

Why was the Tsarist Russia targeted by the Wall Street-funded 1917 Bolshevik Revolution?

In 1860, Tsar Nicholas II (1868-1917) established the Russian State bank creating the people's money out of nothing at almost zero interest. Elementary education was obligatory and free right up to university level. Between 1906 and 1914 10,000 schools were opened annually. Child labour was abolished a century before Great Britain. The foreign trade balance between exports and imports was in surplus and Russia enjoyed the lowest taxation rates in the world: 10 times lower than in Great Britain.

Tsar Alexander I (1801-1825) having declined to set up a foreign-owned central bank, and Tsar Alexander II (1855-1881) having abolished serfdom and transfered 80% of the arable land to peasants, Russia had the world largest gold reserves and smallest national debt (of which less than 2% was held abroad)!

The Tsars in Russia were a deadly threat to the "international bankers" because an independent, debt-free Russia demonstrated to the world how much better the population, science and industry are doing when no robbery takes place via usury and taxation.

Worse, there are people today claiming that the 1917 Communist Revolution that caused 66m Russian deaths improved the social and economic achievements of the Tsars! They claim that, just after killing the Tsar and his family to rob the State gold reserves – the largest in the world, the revenue per head was higher (maybe just after they immediately killed 20m people), or that the organization of society was then more efficient and more human!

Actually, all the advantages granted by the Tsars to the people were confiscated by the Bolsheviks, including the right for strike, to travel abroad, do commerce and own private property. Today, the WEF has same program: all for a very few, nothing for the "happy" masses.

And Sutton has demonstrated "how the Soviet state's technological and manufacturing base, which was then engaged in supplying the North Vietnamese the armaments and supplies to kill and wound American soldiers, was built by US firms and mostly paid for by the... US taxpayers. From their largest steel and iron plant, to automobile manufacturing equipment, to precision ball-bearings and computers, basically the majority of the Soviet's large industrial enterprises had been built with the United States help or technical assistance."

- Antony Cyril Sutton (1925-2002), researcher at the Hoover Institution, Stanford University, former

economics professor at California State University:

• "The Best Enemy Money Can Buy"

• "Wall Street and the Bolshevik Revolution"

• "Wall Street and the Rise of Hitler"

• "Technological Treason"

• "National Suicide: Military Aid to the Soviet Union in 1973"

• "Western Technology and Soviet Economic Development 1917-1930"

• "Western Technology and Soviet Economic Development 1930-1945"

• "Western Technology and Soviet Economic Development 1945-1965"

• "Energy, The Created Crisis"

• "Cold Fusion: The Secret Energy Revolution"

• "Introduction to The Order"

• "How The Order Controls Education"

• "How The Order Creates War and Revolution"

• "The Secret Cult of The Order"

- "200 Years Together, Russo-Jewish History", Aleksandr Solzhenitsyn (1918-2008), Nobel prize Russian writer

The world is not what it seems – because we are continuously been told "fictional stories".

The "international banker" scam devouring the world is centuries-old, so economists have had enough time to give it a name:

"Debasement" is the magic trick of replacing silver by dirty-paper, and have people enjoy the show, applaud and ask for more. Hence trading many times more "paper-gold" than available tangible gold reserves, or breaking the USD-gold convertibility in 1971. These "policies" generating inflation have lowered the good-value of gold, and over-priced the bad-value of electronic-money (replacing dirty-paper, itself replacing silver, itself replacing gold).

The central bank is an institution of the most deadly hostility existing against the Principles and form of our Constitution. I am an Enemy to all banks discounting bills or notes for anything but Coin.

The banking cartel succeeds in creating "false" prices for commodities such as oil, gold and silver through their creation of bogus paper markets (futures, ETFs, etc.), in which sometimes a hundred times or more of the commodity is bought and sold in paper form than exists in real physical form.

With a gun a man can rob a bank, with a bank a man can rob the world.

How Fast It Can Be Undone

We have seen who, how and when. Giving the hundred of millions of deaths caused by this "sinister confederacy" presented by Churchill, the why is obvious. Now, it's time for the world to get back its freedom.

The only way out from the usury trap is to (1) correlate Price to Value again (to avoid this ever-increasing inflation and the exclusion of the people from production to preserve a monopoly held by Finance)... and (2) by restoring our Constitution to get back the interest-free and debt-free money-creation monopoly that was stolen from the State by private interests:

If the American people ever allow private banks to control the issue of their currency first by inflation then by deflation the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered. I believe that banking institutions are more dangerous to our liberties than standing armies. The [monetary] issuing power should be taken from the banks and restored to the people to whom it properly belongs.

Whosoever controls the volume of money in any country is absolute master of all industry and commerce... And when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.

In the colonies we issue our own money. It is called colonial script. We issue it in proportion to the demands of trade and industry to make the products pass easily from the producers to the consumers. In this manner, creating for ourselves our own money, we control its purchasing power, and we have no interest to pay anyone.

At this time, similar arrangements were adopted elsewhere:

Napoléon's first act on assuming power as First Consul in 1799, was to establish the Banque de France on 18 January 1800 replacing the 15 private banks (issuing credit and bank notes) which had been deeply involved in the events leading up to the French Revolution (1789-1799), having increased the national debt by charging rapacious rates of interest on loans to the French crown, to the extent that prior to 1789, it was allocating over 50% of its budget expenditure to interest!

Napoléon upgraded the infrastructure on a vast scale not only in France, but throughout western Europe, with the construction of 20,000 miles (32,186 km) of imperial roads and 12,000 miles (19,312 km) of regional roads, almost 1,000 miles (1,609 km) of canals, bridges, the dredging and expansion of harbours, waterworks and public buildings, such as the gallery at the Louvre – all financed with interest-free money from the Banque de France.

At that time, France and Russia were the only two countries in Europe which were not on the usury system and were therefore the only free and independent nations.

The Tsars in Russia and Napoléon in France were a deadly threat to the "international bankers" because independent, debt-free countries demonstrated to the world how much better the population, science and industry are doing when no robbery takes place via usury and taxation.

And it has been the case of all other debt-free, interest-free initiatives:

History tells us of debt-free and interest-free money issued by governments. The American colonies did it in the 1700's and their wealth soon rivaled England and brought restrictions from Parliament, which led to the Revolutionary War.

Abraham Lincoln did it in 1863 to help finance the Civil War. He was later assassinated by an agent of the Rothschild Bank. No debt-free or interest-free money has been issued in America since then.

The American "Revolutionary War" (1775-1783), also known as the "American War of Independence", was due to the British Empire having imposed the replacement of the colonies debt (largely interest-free colonial scrip) with English money, resulting in 50% unemployment, with a national debt soaring to £176 million.

This war opposed American Patriot forces commanded by George Washington to the British Army in North America, the Caribbean, and the Atlantic Ocean. In 1783, the British monarchy acknowledged the United States as an independent and sovereign nation.

Abraham Lincoln (1809-1865), 16th U.S. President, was assassinated 5 days after General Lee surrendered to General Grant, effectively ending the American Civil War (1861-1865) funded with debt-free and interest-free money issued by the U.S. government.

Germany issued debt-free and interest-free money from 1935 and on, accounting for its startling rise from the depression to a world power in 5 years. Germany finance[d] its entire government and war operation from 1935 to 1945 without gold and without debt, and it took the whole Capitalist and Communist world to destroy the German power over Europe and bring Europe back under the heel of the bankers. Such history of money does not even appear in the textbooks of public (govemment) schools today.

In contrast, today, thanks to the private network of Central Banks, and the Central Banks funded GAFAM (with a $10T stock-exchange valuation) and their galaxy of well-funded minions (despite their abysmal technical competences), the pursued goal seems to furiously accelerate the growth of an unstoppable inflation, because:

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose. [...] If prices are continually rising, every trader who has purchased for stock or owns property and plant inevitably makes profits.

That is, until the whales at the switch decide to replace "pump" with "dump" – thereby transfering the wealth of the abused masses into their sole pockets – because then:

200,000 companies filed for bankruptcy and 8.3 million people were thrown on to the streets. Within three years 24.9% of the working population was unemployed. The total National Income of the United States declined by 40.7% from $81 billion in 1927 to $48 billion in 1932. During the depression years an estimated three million people died of starvation. The main causes were malnutrition, infectious diseases, starvation and suicide.

The guilty was publicly identified – but never held liable, destituted nor punished (a constant when Central Banks own States):

In 2002, in response to a question posed by Professor Milton Friedman to Ben Bernanke, then serving on the Academic Advisory Panel of the US Federal Reserve Bank of New York, about the Great Depression, Bernanke replied, "Regarding the Great Depression. You're right we did it. We're very sorry".

A light excuse for the "three million American deaths due to starvation" not accounting for the lower birth rates and miscarriages, malnutrition, infectious diseases and suicide, and the mis-use of U.S. money to fund the Bolshevik Revolution leading to 66 million Russian deaths:

Mr. Chairman, we have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks.

The Federal Reserve Board, a Government board, has cheated the Government of the United States and the people of the United States out of enough money to pay the national debt. The depredations and the iniquities of the Federal Reserve Board and the Federal Reserve Banks acting together have cost this country enough money to pay the national debt several times over.

This evil institution has impoverished and ruined the people of the United States; has bankrupted itself, and has practically bankrupted our Government. It has done this through the defects of the law under which it operates, through the maladministration of that law by the Federal Reserve Board, and through the corrupt practices of the moneyed vultures who control it.

Some people think the Federal Reserve Banks are United States Government institutions. They are not Government institutions. They are private credit monopolies which prey upon the people of the United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders. In that dark crew of financial pirates there are those who would cut a man's throat to get a dollar out of his pocket; there are those who send money into the States to buy votes to control our legislation; and there are those who maintain international propaganda for the purpose of deceiving us and of wheedling us into the granting of new concessions which will permit them to cover up their past misdeeds and set again in motion their gigantic train of crime.

Those 12 private credit monopolies were deceitfully and disloyally foisted upon this country by bankers who came here from Europe and who repaid us for our hospitality by undermining our American institutions. Those bankers took money out of this country to finance Japan in a war against Russia. They created a reign of terror in Russia with our money in order to help that war along, instigated the separate peace between Germany and Russia and thus drove a wedge between the allies in the World War. They financed Trotsky's mass meetings of discontent and rebellion in New York. They paid Trotsky's passage from New York to Russia, so that he might assist in the destruction of the Russian Empire. They fomented and instigated the Russian Revolution and they placed a large fund of American dollars at Trotsky's disposal in one of their branch banks in Sweden so that through him Russian homes might be thoroughly broken up and Russian children flung far and wide from their natural protectors. They have since begun the breaking up of American homes and the dispersal of American children. [...]

In 1912 the National Monetary Association, under the chairmanship of the late Senator Nelson W. Aldrich, made a report and presented a vicious bill called the National Reserve Association Bill. This bill is usually spoken of as the Aldrich bill. Senator Aldrich did not write the Aldrich bill. He was the tool, but not the accomplice, of the European-born bankers who for nearly 20 years had been scheming to set up a central bank in this country and who in 1912 had spent and were continuing to spend vast sums of money to accomplish their purpose. [...]

One of the greatest battles for the preservation of this Republic was fought out here in Jackson's day, when the Second Bank of the United States, which was founded upon the same false principles as those which are exemplified in the Federal Reserve Act, was hurled out of existence. After the downfall of the Second Bank of the United States in 1837, the country was warned against the dangers that might ensue if the predatory interests, after being cast out, should come back in disguise and unite themselves to the Executive, and through him acquire control of the government. That is what the predatory interests did when they came back in the livery of hypocrisy and under false pretences obtained the passage of the Federal Reserve Act.

The danger that the country was warned against came upon us and is shown in the long train of horrors attendant upon the affairs of the traitorous and dishonest Federal Reserve Board and the Federal Reserve Banks. Look around you when you leave this chamber and you will see evidences of it on all sides. This is an era of economic misery and for the conditions that caused that misery, the Federal Reserve Board and the Federal Reserve Banks are fully liable. This is an era of financed crime and in the financing of crime, the Federal Reserve Board does not play the part of a disinterested spectator. The people of the United States are being greatly wronged.

If they are not, then I do not know what “wronging the people” means. They have been driven from their employments. They have been dispossessed of their homes. They have been evicted from their rented quarters. They have lost their children. They have been left to suffer and to die for the lack of shelter, food, clothing and medicine.

The wealth of the United States and the working capital of the United States has been taken away from them and has either been locked in the vaults of certain banks and great corporations or exported to foreign countries for the benefit of the foreign customers of those banks and corporations. [...]

The sack of the United States by the Federal Reserve Board and Federal Reserve Banks and their confederates is the greatest crime in history.

Mr. Chairman, a serious situation confronts the House of Representatives today. We are the trustees of the people and the rights of the people are being taken away from them. Through the Federal Reserve Board and the Federal Reserve Banks, the people are losing the rights guaranteed to them by the Constitution. Their property has been taken from them without due process of law. Mr. Chairman, common decency requires us to examine the public accounts of the Government to see what crimes against the public welfare have been or are being committed.

What is needed here is a return to the Constitution of the United States. We need to have a complete divorce of Bank and State. The old struggle that was fought out here in Jackson's day must be fought over again. The Independent United States Treasury should be re-established and the Government should keep its own money under lock and key in the building the people provided for that purpose. Asset currency, the device of the swindler, should be done away with.

The Government should buy gold and issue United States currency on it. The business of the independent bankers should be restored to them. The State banking systems should be freed from coercion. The Federal Reserve districts should be abolished and state boundaries should be respected.

Bank reserves should be kept within the borders of the States whose people own them, and this reserve money of the people should be protected so that international bankers and acceptance bankers and discount dealers cannot draw it away from them. The exchanges should be closed while we are putting our financial affairs in order. The Federal Reserve Act and the Federal Reserve Banks, having violated their charters should be liquidated immediately.

Faithless Government officers who have violated their oaths of office should be impeached and brought to trial. Unless this is done by us, I predict that the American people, outraged, robbed, pillaged, insulted, and betrayed as they are in their own land, will rise in their wrath and send a President here who will sweep the money changers out of the temple.

Louis T. McFadden was assassinated on October 1, 1936.

Banking was conceived in iniquity and was born in sin. The bankers own the earth. Take it away from them, but leave them the power to create deposits, and with a flick of the pen they will create enough deposits to buy it back again.

However, take it away from them, and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of the bankers and pay the cost of your own slavery, let them continue to create deposits.

What Good Is To Be Expected

How much better life was before usury took over the world? This freely available PDF book (142 pages without the appendix, book-reviews and references) tells it (with 313 references) but it also explains how we have reached today's sorry state of things, exposing how the USA, England, Germany, France, Russia, Japan, Libya, South-Africa, Australia and China have shined – until they were slowly infiltrated and subverted, by ruthless foreign interests:

State banking and the sovereign issue of a nation's money supply are the only means for the provision of a natural order of harmony, peace and prosperity founded on the ethnic independence of all peoples.

With tolerable taxes, no state debt and no interest to pay, [14-15th century] England enjoyed a period of unparalleled growth and prosperity. The average labourer worked only 14 weeks and enjoyed 160 to 180 holidays. [...] A labourer could provide for all the necessities his family required. They were well clothed in good woollen cloth and had plenty of meat and bread.

Within two years of its establishment in 1696 the Bank of England had £1,750,000 worth of bank notes circulating with a gold reserve of only 2% or £36,000.

Henceforth a pattern would emerge where unnecessary wars would be embarked upon which simultaneously increased the national debt and the profits of the usurers. Significantly, most of these wars were started against countries that had implemented interest-free state banking systems, as was the case in the North American colonies and France under Napoléon.

This pattern of attacking and enforcing the bankers' system of usury has been deployed widely in the modern era and includes the defeats of Imperial Russia in World War I, Germany, Italy and Japan in World War II and most recently Libya in 2011.

These were all countries which had state banking systems, which distributed the wealth of their respective nations on an equitable basis and provided their populations with a standard of living far superior to that of their rivals and contemporaries.

The German economy, during the period 1933-39 had increased its Gross National Product by 100 percent. From being a ruined and bankrupt nation in January 1933 with 7,500,000 unemployed persons, Hitler had transformed Germany into a modern socialist paradise.

One of the primary benefits which state banking and monetary reform conferred on the German people was the provision of adequate housing. During the period 1933-37 1,458,178 new houses were built to the highest standards of the time. Each house could not be more than two stories high and had to have a garden. The building of apartments was discouraged and rental payments on housing were not permitted to exceed RM25 per month or 1/8 of the income of an average worker. Employees earning higher incomes paid a maximum of RM45 per month.

Interest free loans of RM1,000 (about five months of gross pay) known as Ehestanddarlehen (marriage loans) were paid in certificates to newly-wed couples to finance the purchase of household goods. The loan was repayable at 1% per month, but for each child born 25% of the loan was cancelled. Thus if a family had four children, the loan would have been considered repaid in full. The same principle was applied in respect of home loans, which were issued for a period of ten years at a low rate of interest. The birth of each child also resulted in cancellation of 25% of the loan. Education in schools, technical colleges and universities was free, while the universal health care system provided everyone with free medical care.

As part of the Kraft durch Freude (Strength through Joy) programme, German workers earning less than RM300 a month were able to embark on cruises to exotic destinations. However, these cruise ships were forbidden entry into British ports for fear of creating unrest and envy amongst deprived and unemployed British workers.

As a result of all this heightened and ever increasing economic activity, unemployment, which stood at 30.1% in 1933, had been reduced to almost zero by July 1939, and retired workers had to be enticed back to the labour market in order to make up for the shortage of skilled workers. In contrast the unemployment rate in the United States, which had stood at 25.1% in 1933, had according to the National Industrial Conference Board declined only marginally to 19.8% by January 1940; a situation which may be attributed to the irrational but nonetheless deliberate policies of the Rothschild controlled Federal Reserve Bank and the parasitic private banking sector.

The German monetary policy was non-inflationary because government expenditures, which increased the level of consumer demand, could in turn elicit a correspondingly increased quantity of disposable consumer goods.

By 1939 Germany had become the most powerful country in the history of Europe. Its Gross Domestic Product at an annual average growth rate of 11% per annum had doubled in the short space of six years of quasi-state banking. The Germans were now the happiest and most prosperous people in the world, fully employed and enjoying one of the highest standards of living. This success was achieved by the hard work of the German people and with the support of an honest money system not based on usury or the gold standard. One of the myths propagated by establishment historians is that Germany's economic renaissance was based on armaments production. Defence expenditure only picked up in 1938/1939 when Germany started to feel threatened by her neighbours. [...] A. J. P. Taylor, writes that "The state of German armament in 1939 gives the decisive proof that Hitler was not contemplating general war, and probably not intending war at all".

Hitler was now his own banker, but having departed from the fold of international swindlers and usurers he would, like Napoléon Bonaparte, who in 1800 had established the Banque de France as a state bank, suffer the same fate; an unnecessary war followed by the ruination of his people and country. It was this event which triggered World War II – the realisation by the Rothschilds that universal replication of Germany's usury-free state banking system would permanently destroy their evil financial empire.

On the orders of the international bankers, the British Foreign Secretary, Lord Edward Wood Halifax, strongly advised the Polish government not to negotiate. This is how and why World War II was started and disposes of the canard of German culpability. From 1939 onwards, although Germany made at least 28 known attempts at peace without conditions, they were all refused. The ensuing forced war resulted in victory for the international financiers and defeat and slavery for the people of Europe and indeed the world. In Europe this enslavement was finally achieved with the establishment of the Rothschild controlled European Central Bank [ECB] on 1 June 1998 and the introduction of the euro on 1 January 1999.

The principal objective of the ECB as laid down in Article 127 (1) of the Treaty on the Functioning of the European Union, is to maintain price stability. This obsession is largely responsible for the record levels of unemployment and low levels of growth in GDP currently being experienced, and the ongoing collapse in the birth rate.

At the start of World War I in 1914 [England's] national debt stood at £650 million. On March 31, 1919 it had increased to £7.434 billion of which £3 billion is still outstanding after 95 years at an interest rate of 3.5% per annum. In the 1919 budget 40% of expenditure was allocated to the payment of interest. In World War II the national debt rose by almost 300% from £7.1 billion in 1939 to £20.1 billion in 1945. As at March 2017 it stands at over £1.8 trillion. However, if one includes all liabilities, including state and public pensions, it exceeds £5 trillion.

The underlying reason why the developed world, which has in the past produced superior, long-lasting products, has been partially deindustrialised, is so that inferior goods have to be continually produced by third world countries in order to fuel the growth syndrome. It also highlights the absurdity of the insistence that Europe needs economic growth when its indigenous population is shrinking. This policy of deliberately planned obsolescence and forced growth also has very deleterious effects on the environment. As will be observed in the final section, the collapse in female fertility rates in the developed world, which is a direct consequence of usury, will lead to the extinction of civilisation.

The factor which overrides all these macro economic considerations is the collapse in the birth rate of the developed world. At the turn of the twentieth century the White population of the world numbered 590 million or 36% of its 1.65 billion total. In 2016 although that number had increased absolutely to 1 billion, its relative share of the world's population of 7.5 billion has shrunk to 13.3%. Two fratricidal and pointless world wars over the maintenance of the usury system set this catastrophic decline in motion.

In conclusion it may be stated that the principal hidden purpose of the banking crisis is to create a general feeling of desperation and an acclamation for a solution such as a World Central Bank – a similar situation which prevailed in the United States during the late nineteenth century when banking panics were being artificially created in preparation for the imposition of the US Federal Reserve Bank. Whether the parasitic bankers will achieve this objective is open to doubt as the host may well have vanished by then.

The past 300 years, notwithstanding numerous technological advancements, have witnessed a progressive deterioration in Western and European standards of civilisation. The excessive concentration of power and wealth, based exclusively on dishonest banking methods, has enabled a tiny minority of criminal bankers to control the media and educational processes, and thereby to brainwash a mindless and atomised humanity, deluded by the spurious comforts of democracy and materialism, into suicidal practices of savage, bloody and pointless wars, central banking and cultural degradation, which will eventually result in its demographic extinction.

A Documented Example, Reichsbank: The State Bank of National Socialist Germany

We have seen the problem, its causes, and how many countries have instantly resolved both (before being taken-down by wars launched by a coalition of united banking fraudsters).

We will now see how the solution worked for 1935 Germany, starting with a former construction engineer turned economist and Reichskommissar, Dr. Gottfried Feder (1883-1941) giving a 1919 lecture entitled "The Abolition of Interest Servitude".

Money is required by farmers to sow and harvest, by manufacturers to hire qualified workers and then buy materials to build things, and by merchants to buy and store – before any of them can start to generate revenue.

If a large part of the population lacks access to money (like in Capitalism or Communism), then only a very few well-funded economic players can exist, leading to ever-growing monopolies, ever-rising Prices detached to the delivered Value, and to an ever-degrading quality due to the lack of competition.

Worse, as bankers only decide how much money is created, given to who, to do what, they have the power to pick who will live and who will die, what technology is allowed (or not) to reach the market, what works or books are published, and what is taught (or not) in schools. The only way to stops abuse is to prevent, by design, such a private concentration of power to arise in our society.

The main idea was disarmingly simple: to prevent the supposely indispensable "international finance" (globalization) from compromizing national interests, an independent nation must have its own source of capital. In fact, no sovereignty can exist without it:

I fear that foreign bankers with their tortuous tricks will entirely control the exuberant riches of America and use it systematically to corrupt modern civilization. They will not hesitate to plunge the whole world into wars and chaos in order that the earth should become their inheritance.

If private foreign banks create their money ex nihilo (out of thin air), there is no reason why a sovereign country could not do it too. And, avoiding inflation (mandated by interest debt money to let borrowers pay back their loans) is simply done by limiting monetary creation to productive goals.

Interest debt money is "capital versus labor, blood versus money, creative work versus exploitation". Interest-free debt-free money is the only way out from slavery. Then only happiness, prosperity and civilisation can be restored – throughout the world.

The financial principle of Dr. Feder's 1932 "The National Socialist German Workers' Party and its General Conceptions":

- "Finance shall exist for the benefit of the state; the financial magnates shall not form a state within the state."

- "Relief of the state, and hence of the nation, from its indebtedness to the great financial houses, which lend on interest."

- "Nationalisation of the Reichsbank and the issuing houses, which lend on interest."

- "Provision of money for all great public objects (waterpower, railroads etc), not by means of loans, but by granting non-interest bearing state bonds and without using ready money."

- "Introduction of a fixed standard of currency on a secured basis."

- "Creation of a national bank of business development (currency reform) for granting non-interest bearing loans."

- "Fundamental remodelling of the system of taxation on socioeconomic principles. Relief of the consumer from the burden of indirect taxation, and of the producer from crippling taxation (fiscal reform and relief from taxation)."

- "Wanton printing of bank notes, without creating new values, means inflation. We all lived through it. But the correct conclusion is that an issue of non-interest bearing bonds by the state cannot produce inflation if new values are at the same time created."

- "The fact that today great economic enterprises cannot be set on foot without recourse to loans is sheer lunacy. Here is where reasonable use of the state's right to produce money which might produce most beneficial results."

In January 1939 the President of the Reichsbank, Hjalmar Schacht, refused extension of three billion bills, because of fears of inflation and signed a memorandum by nine board members of the Reichsbank, which contained the following main points:

- The Reich must spend only that amount covered by taxes.

- Full financial control must be returned to the Ministry of Finance.

- Price and wage control must be rendered effective. The existing mismanagement must be eliminated.

- The use of money and investment markets must be at the sole discretion of the Reichsbank.

Schacht wanted to kill the German economy, which in 5 years went from a ruined and bankrupt nation with 7.5m jobless persons to an economic world leader enjoying full-employment (in July 1939 38,379 persons were registered as unemployed), having doubled its Gross National Product from 1933 to 1939.

Schacht was sacked – removing from the "international bankers" the power to deflate and destroy the German economy, and the slightly renamed "Deutsche Reichsbank" became an authentic State Bank, "unconditionally subordinated to the sovereignty of the state".